First off, Kung Hei Fat Choi to all my Cantonese brothers out there!!!

Quick followup on last week's names after an eventful 3 days in everything tech and China-related:

$VNET (LONG): VNET has gained +8.3% since last week, with traders apparently a bit confused about whether it is a beneficiary or victim of DeepSeek, BABA's newly released Qwen 2.5-VL (vision language) model, or any number of other Chinese AI models now gaining the attention of US investors previously blissfully unaware of technological happenings in China. We think VNET is an unequivocal net winner from China's AI proliferation and we derived additional confidence from META's overnight comments regarding the scaling and monetization of its AI investments in 2025/26. In short, we believe that VNET's largest customers, ByteDance (Doubao, local version of TikTok) and Tencent are best positioned to monetize AI services in China by virtue of their massive existing social networks, and the fact that both have historically underinvested in data center capacity due to regulatory concerns and weak monetization (no existing AI bot in China has yet realized any significant revenue). However, Chinese AI spending began to accelerate in Q3 2024 and will more than double in 2025, with VNET being uniquely positioned to capture the demand. The chart is due for some consolidation, but will likely continue to run if China tech enthusiasm continues to build (after a long, cold winter).

$WAY (LONG): Waystar (WAY) +7.5% since last week. Waystar is a healthcare payment provider serving both large hospitals and small medical practices. The company has gained share in a growing TAM due to the fact that its main competitors are either captive companies under large managed care networks (e.g., UNH, Tenet) or have suffered security breaches in recent history. WAY's business model is well-positioned to profit from ongoing trends/bottlenecks in the US healthcare industry such as administrative labor shortages and the management of claim denials.

$BAH (SHORT): BOOZ ALLEN HAMILTON (BAH) -6.7% WoW is once again under pressure after peers reported declining order backlogs from their main customer (the US government) and the firm was named in a major class action lawsuit involving the Snowden-esque leak of thousands of IRS tax returns by a BAH employee contracted to work at the IRS. This type of news and associated filings highlight the incompetence and dishonesty of overpriced government contractors like BAH. We believe firms like BAH, CACI, and PSN will face increasing pressure from DOGE and society at large -- who would like to see the federal government undertake a proper fundamental systems revamp as opposed to employing technologically backward companies such as BAH to supply basic IT support for legacy systems. (Caution: BAH reports earnings pre-market on 31 Jan 2025)

As a general observation on the performance of stocks identified by our screens in recent weeks, weekly momentum has been an especially poor timing tool for traders YTD. Market leadership has changed on a weekly basis in response to the weekly headlines (e.g., natural gas, CES keynotes, CPI, DeepSeek). We would suggest that traders get smaller, less active, and wait for the opportunities that are likely to be provided by Q4 earnings and an extremely energetic incoming Trump cabinet.

Trade safely and don't chase!

— Leroy

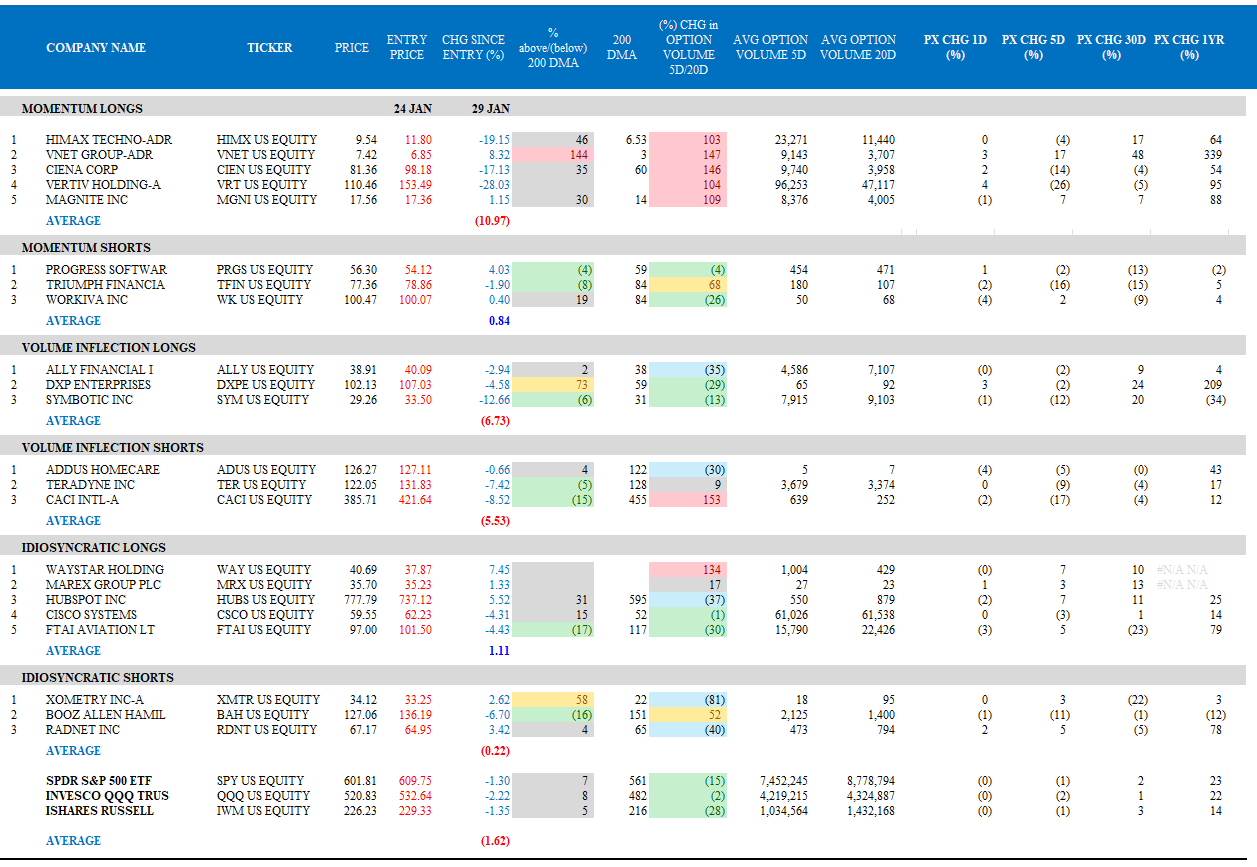

UPDATED PERFORMANCE OF 24 JAN 2025 SCREENS: